If You Score More Than 4 on This Test, Your Startup Is on Track for Year-End

As the financial year draws to a close, the pressure on startup founders and finance teams intensifies. The looming deadlines for tax filing, closing accounting books, and strategic planning for the coming year can create a high-stress environment. To help you navigate this critical period, Klub presents a comprehensive scorecard to measure your financial readiness. Achieve the tasks outlined below and secure your startup's success in the year end closing.

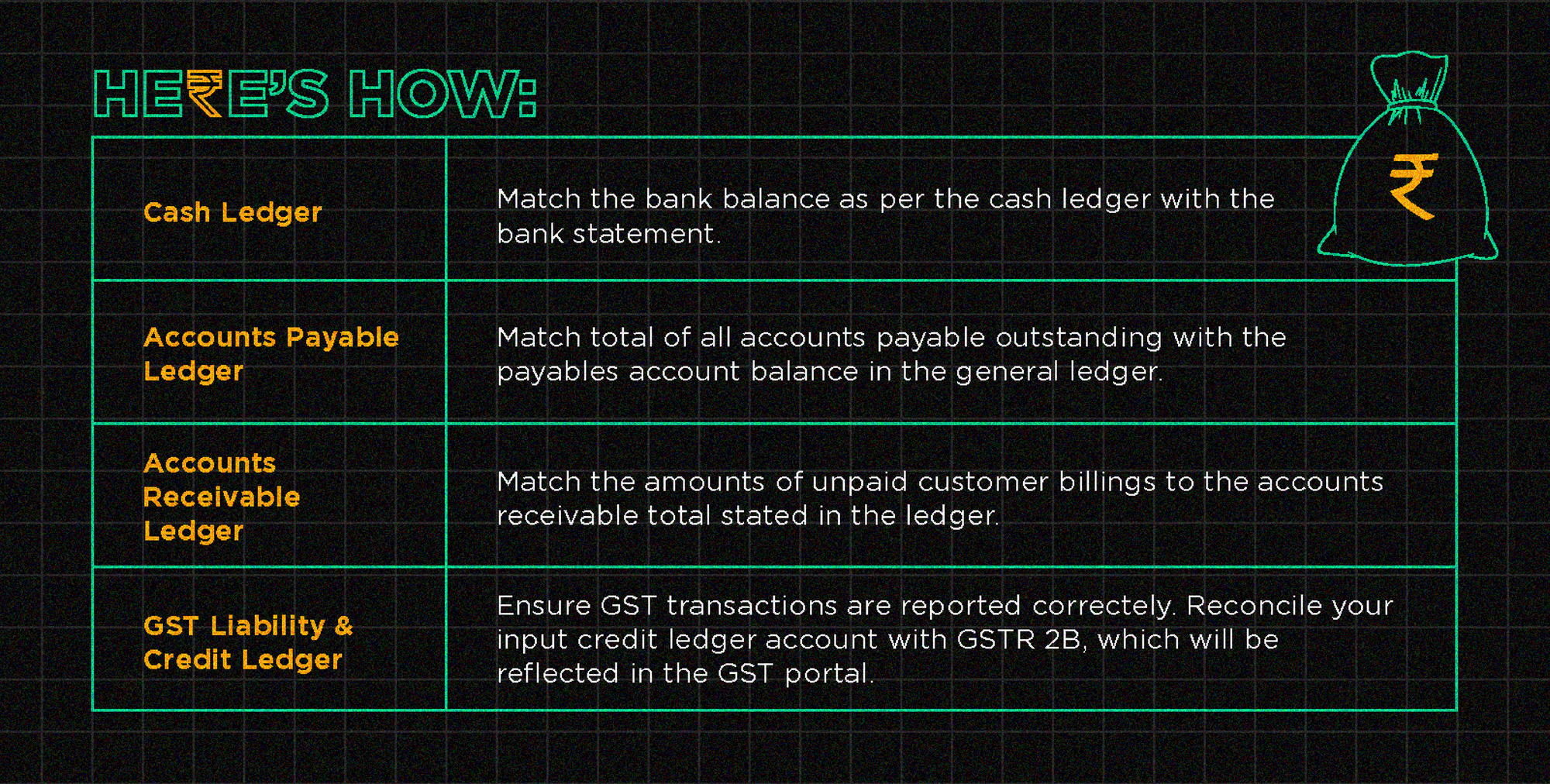

Reconcile All Ledgers - 2 pts

Reconciliation of all accounts is one of the most critical tasks in closing the financial year. It involves comparing two sets of financial records, such as bank statements and corresponding entries in the accounts of the company, to ensure that all transactions have been recorded accurately. No matter how meticulous you were, there is always a possibility of wrongful data entry or lost invoices. Even the slightest error can throw your books out of balance. This should be done by the 31st March, 2023.

Calculate and Pay Advance Tax - 2 pts

Advance tax refers to paying a portion of your income tax liability in advance. During a financial year, from 1st April to 31st March, advance income tax is payable on or before 15th June, 15th September, 15th December, and 15th March.

Pay and File TDS Returns - 2 pts

If your company’s payments- rent, commission, professional fees, or salary exceed a certain limit, you must deduct TDS.

- Pay on Time- The deadline for making TDS payments is 30th April, 2023. Ensure that all your TDS payments for March are deducted and deposited to the government before that.

- File TDS Returns- You need to file TDS returns for the Jan-March quarter by 31st May, 2023.

Plan for the Year-End Payroll - 2 pts

It is critical that you plan for the year-end payroll processing as it is one of the most significant expenses for the company. Here is a checklist to go by:

- Tax-Saving Declarations- Collect the corresponding proofs for tax-saving declarations made by your employees. This helps you calculate accurate TDS and deposit it to the government on time.

- Verifying and Updating Data- It’s normal to find gaps in employee data. You should rectify any gaps or errors by 31st March, 2023. Check information like dependent details, particulars of the nominees, PAN, Aadhar details etc.

- Bookkeeping and Closure of Salary and Statutory Expenses- By 31st March, close out expenses like salary payout, social security contributions, Professional Tax payments, and other outstanding payments like reimbursements, arrears etc.

- Issue Form 16- Form 16 is the certificate of Tax Deduction issued by the employer for its employees. It is mandatory to issue these certificates to all employees. The due date for this is 15 June.

The only thing cooling down entrepreneurs more than an AC during this time of the year is their CA🤓

— Klub (@klubworks) March 22, 2023

Close all Accounting Books - 2 pts

The final step in ensuring a hassle-free year-end is to close out all the accounting books. This can help the company get a sense of the financial health of the business and optimize and plan accordingly for the coming year.

Calculate the revenue earned this year along with the costs incurred by the business and make sure its recorded correctly in the accounting books. Next, update the fixed asset register so that you can claim depreciation on Fixed Assets. Lastly, make a provision for which vendor bills have not been received by 31st March 2023.

How did you perform?

> 8 points: Congratulations! You've mastered year end closing financial preparedness.

4-8 points: You're on track, but the clock is ticking—only 8 days left!

< 4 points: Buckle up! Seek advice from Klub's verified financial advisors for a successful year end closing. Stay tuned for a list of contacts.

Empower your startup for a stress-free year end closing by following Klub's scorecard. Navigate the intricate landscape of financial tasks, stay on track, and position your business for success in the upcoming year. Don't let the pressure get to you – master the art of year end closing financial preparedness with Klub's expert guidance.