5 thumb rules for every time you think of funding

The underlying motivation to become an entrepreneur is to capitalise on innovation to pull off things that haven’t been done before, which stems from their experimental and free nature. Leveraging new capital products to employ a new way of funding your own growth is how businesses evolve.

We love listening to our CEO & Co-founder, Anurakt Jain talk about the future of startup funding in India - Revenue Based Financing. Naturally, when he conducted a workshop for Kalaari Capital on “How can brands unlock cash flows through Revenue Based Financing”, we were on the lookout for insightful learnings from the session.

We did find some interesting ones and here’s a round-up of our strongest takeaways from the session in case you missed it:

1. Equity or Debt?

The era of "growth at all costs" is firmly over. Venture capital firms ask companies to reduce burn that leads to cost-cutting and laying off employees. The conclusion is that a funding slowdown is happening and we all know about it. But does that mean companies should start slowing down their business and in some dire situations even shut them down? NO.

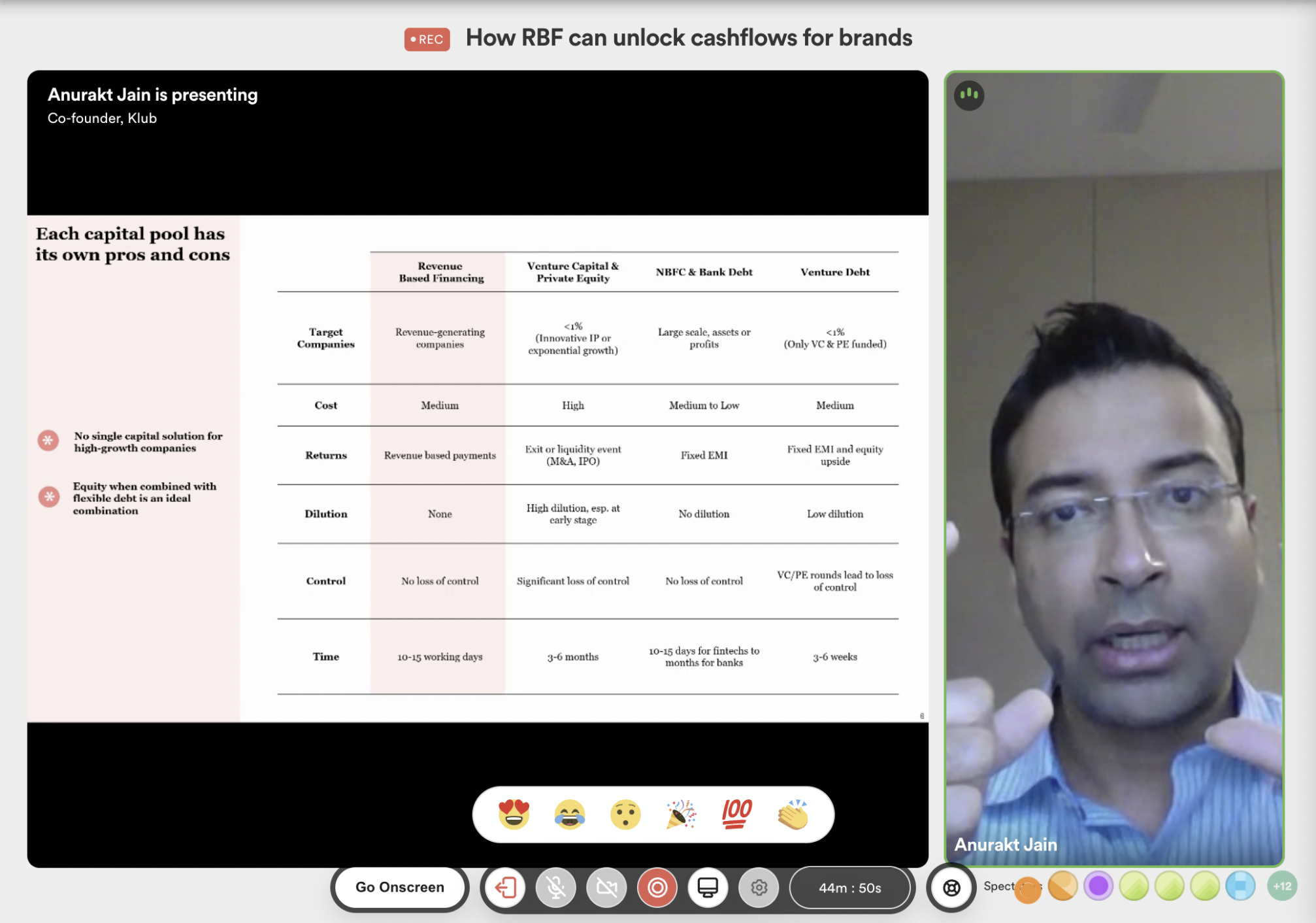

Across businesses, equity funding has been celebrated over decades and there is nothing wrong with it. But we should also not turn a blind eye to other formats of financing. The larger narrative should not be about equity or debt as it has always been but it should be equity and debt, together.

- Anurakt Jain

The deployment of equity capital vs debt capital varies based on industry & use cases. Hence, any company needs more than one source of capital to grow and scale sustainably.

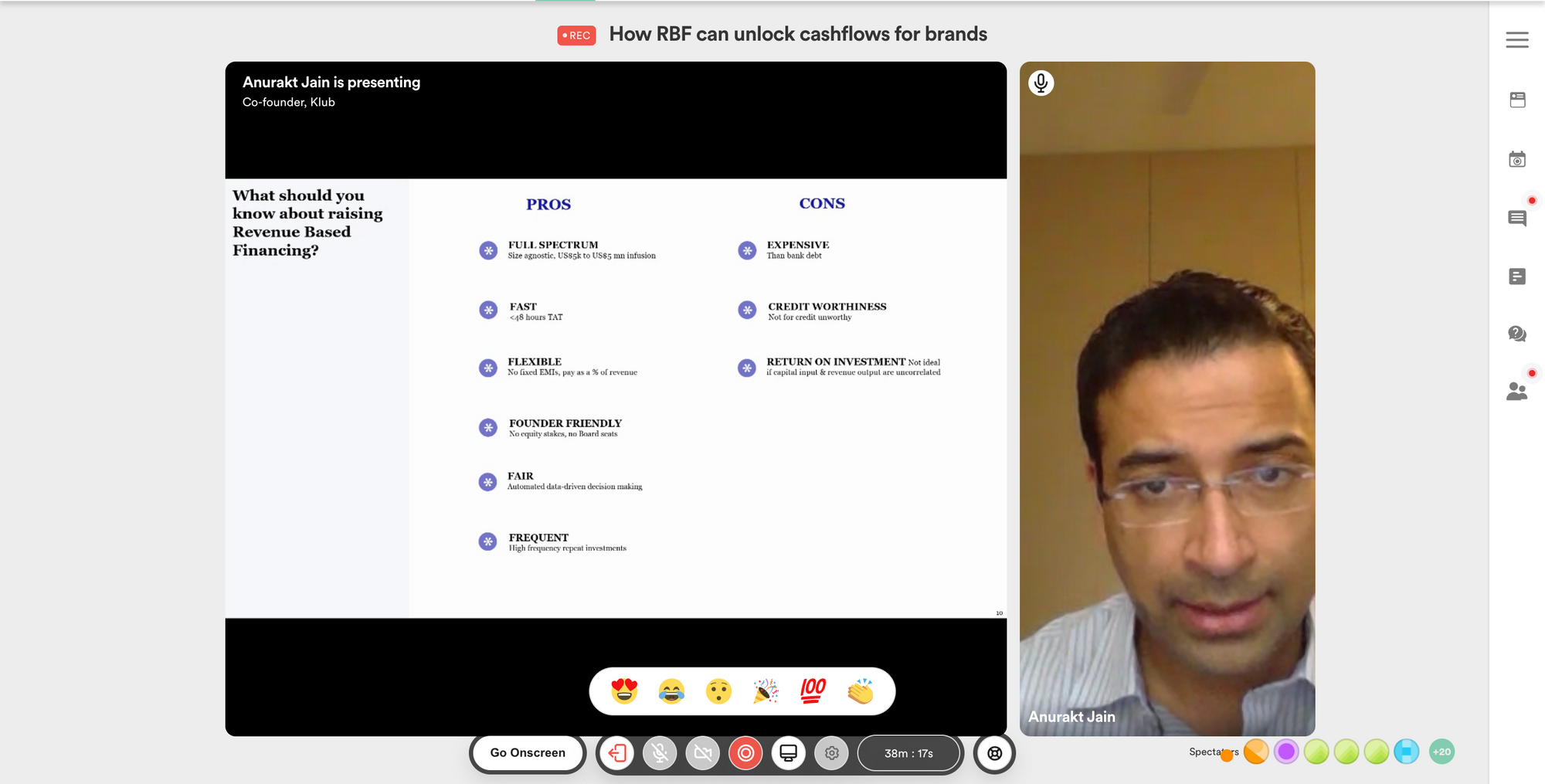

2. Revenue Based Financing is not cheap

Think of it like you choose to keep certain subscriptions active for apps and tools which provide a basic service (capital, in this case) but the functionality offers more convenience and personalisation for your use. Like ad-free music on Spotify, ad-free videos on YouTube, extra swipes or super likes on Tinder/Bumble, etc. Revenue Based Financing gives you increased power over your liquidity so you can divert cash flows towards business priorities during lean months & pay higher proportions of your principal amount during successful months.

It is more expensive than bank debt but it is fast and founder-friendly. It’s best used when you have recurring revenues and have a high RoI use case planned to deploy the funds you have raised.

3. Never-ending success stories

Several businesses across sectors have successfully deployed funds raised through Revenue Based Financing. One of India’s most popular fashion brands channelled ~16.5 Cr. over 7 rounds to build a digital marketing engine & launch a knockout influencer campaign to grow sales exponentially during the festive season. Another great example is India’s leading coffee shop chain unlocked growth via offline store expansion from 15 to 35 stores through 6 funding rounds and ~6.5 Cr in quantum.

4. Boosting revenues during the festive season

Revenue Based Financing has been utilised during the festive season by D2C brands and cloud kitchens because a flexible injection of capital unlocks high return on investment for brands as they spend working capital on inventory, marketing, influencer onboarding and advertising. Shorter tenure RBF arrangements can help with working capital and longer growth plans like offline expansion and new product launches can be funded through longer tenures of RBF and rotating credit lines.

Beyond this, such growth will pave the way for subsequent equity rounds that you may be eyeing for your startup. You build a stronger foundation for your next round of equity funding with every growth milestone you achieve every year.

5. It’s never too late to learn

The underlying motivation to become an entrepreneur is to capitalise on innovation to pull off things that haven’t been done before, which stems from their experimental and free nature. Leveraging new capital products to employ a new way of funding your own growth is how businesses evolve.

Being sceptical about new styles of fundraising may seem daunting but knowing more about options at your disposal never hurt anybody :)

Join the klub to experience the new way of funding - Apply here