Equity Dilution: Protect Your Cap Table With Debt

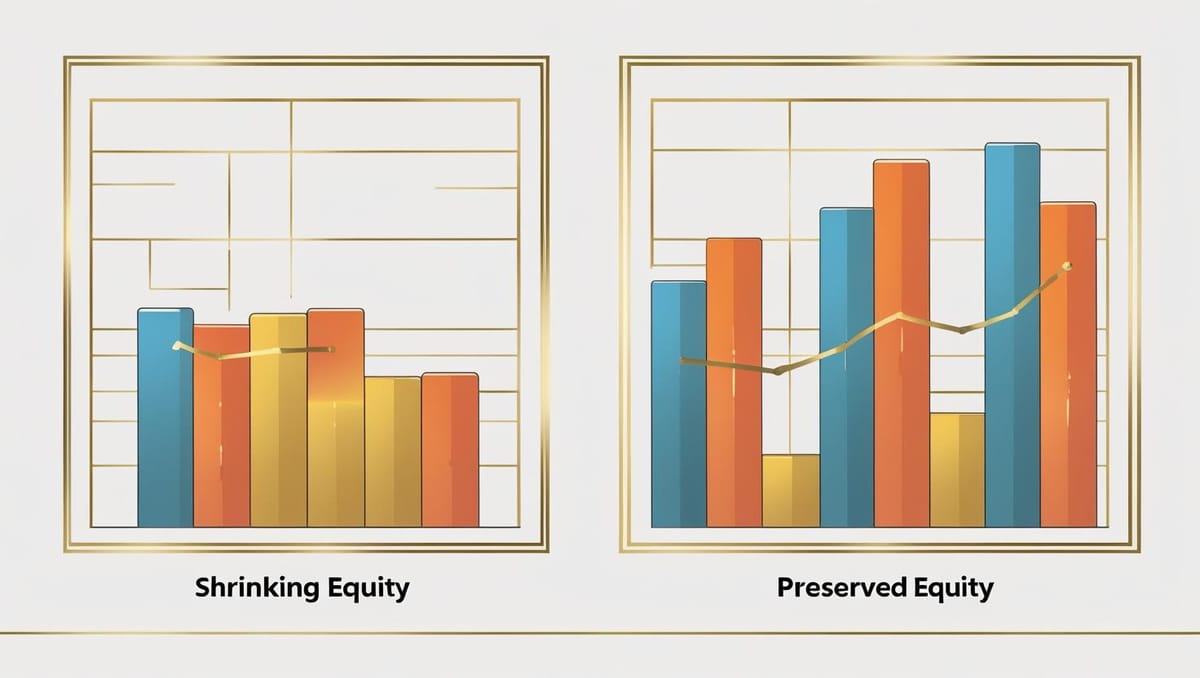

Every 1 % of equity today could be millions at exit. Yet founders often give it up to avoid interest costs.

Fast Calculator Exercise

- Enter current valuation, target raise, and projected exit value.

- Compare founder ownership under equity-only vs mix of equity + revenue-share loan.

- Note how a 10 % debt component can preserve several percentage points of ownership.

Action Steps

- Model multiple scenarios before every fund-raise.

- Share dilution charts with early employees—they care too.

- Keep repayment curves realistic; don’t starve growth to pay debt.

Keywords: equity dilution vs debt, founder ownership, non-dilutive capital, startup funding UAE

Hashtags: #KlubAI #EquityDilution #NonDilutiveFunding #StartupFinance #CapTable

Disclaimer: Illustrative only; consult a financial advisor before structuring your round.