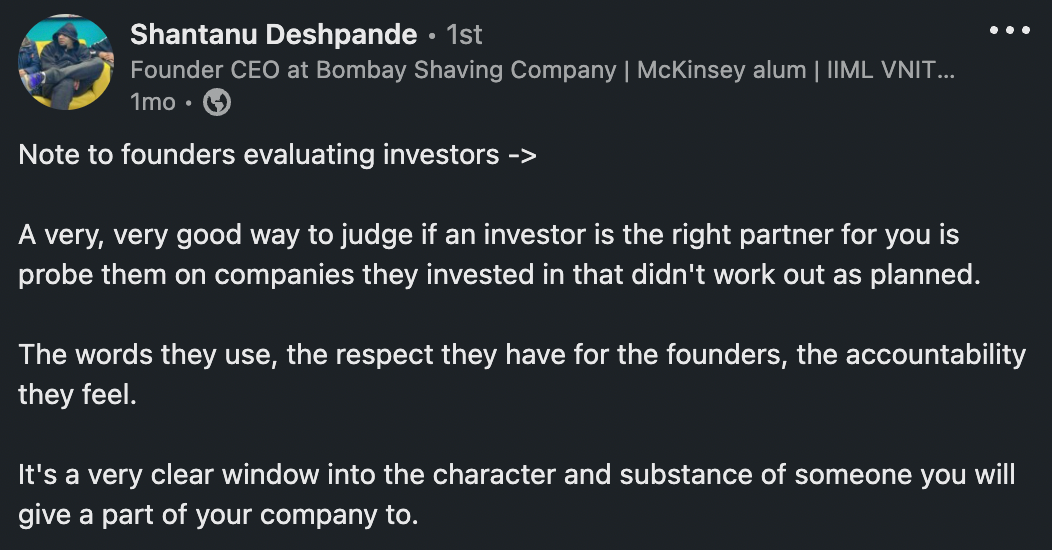

We asked Shantanu Deshpande to tell us what to look for in an investor. Here's what we were told 📢

Today, we bring to you lessons from someone who’s been there done that but most importantly, someone whose posts on Linkedin grab eyeballs. Why? Because at Klub we speak with founders day and night and have 200+ brands on our portfolio and if there’s one thing we’ve learned in the process and from Shark Tank India, it’s this - all founders want funding because it’s great PR but most founders don’t know who and how to pick investors who will prove to be a real value-add to their businesses. Especially in today’s time when both demand and supply of funding are approaching a market equilibrium, well almost.

The difference between a good and a bad investor is your chance at becoming a global unicorn vs your company sold for zero rupees to a big market player.

So lately, as Bombay Shaving Company announced their recent funding (the recent one being a Series C of Rs. 160cr), we noticed Shantanu Deshpande’s (Founder and CEO) most honest and relatable posts about investors that we absolutely loved. So, we asked him to help us put together our own list of "How to pick good investors for your business". And he agreed!

So here’s what he had to say.

There has never been, and probably never will be, a market more suitable for starting a new company than India in 2022. Global interest rates and China's spooky policies will see India as the only real place one could meaningfully deploy growth capital. The consumer class is booming - urbanisation, lower saving rates, better jobs will see a fast-growing and aspiring middle class. Everyone has access to an internet-enabled phone. India has always had talent, especially tech talent. Now, we're seeing the reverse brain drain as people are coming back here to start up. 42 unicorns in 2021 alone - successful founders are achieving social status like cricketers and Bollywood stars. India has a stable government and one that is vocally supportive of startups.

Yes, the golden age for Indian entrepreneurship is upon us.

In such an ecosystem, it is imperative that founders be protected. One of the largest risks for a founder/startup is the choice of a bad investor. We have seen companies get derailed because investors chose self-interest above the company.

Here are a few guidances for founders raising capital in today's market

- Alignment of vision 👓 Be ruthless in evaluating if the investor aligns with your vision. Are they looking at the market and outcomes similar to you? If not, there will invariably be a point where the investor will either push for an expansion or an acceleration - and both could hurt the company. Find an investor who speaks your vision and helps you dream it.

- Long term and patient capital 💰 Investors have fund cycles, companies don't. An investor who buys into you to 'uptick and sell' may have a myopic view on your company and force short term gains. Get a sense of how long the investor plans to be around, are they looking for 'the next buyer'. Because this impatience is a huge distraction on the board.

- Character is visible in bad times ⚓ Get references on the investor from founders/companies who struggled. In good times, everyone is great. But, real character shines through when there is a struggle. Did the investor help solve the problem? How supportive were they? When the going gets tough, how tough are they?

- Continuity ✍️ There should be long term consistency of thesis, investment appetite and strategic direction. Only then is an investor really able to add long term value.

- Help raise the next financing round 🤑 One of the most crucial responsibilities of an investor is to help the company raise future rounds. Sensitising investor community with the story, investment thesis, helping founders pitch, evaluate future investors, onboard bankers etc. - good investors are incredible at drumming up support (and FOMO! :)) for future financings.

Most of all, as a founder, evaluate if you genuinely want to call the investor up when you feel like you need a soundboard. That is the ultimate litmus test.

India is a deep, rich market and there are unlimited sources of good capital. Capital itself is a commodity, ensure you get the best source for your company.

On a very side (and not so subtle) note, if you have recurring revenues and are looking for the perfect investor, it is about time you join the Klub! Just a click away 🚀